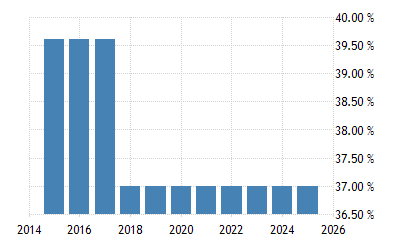

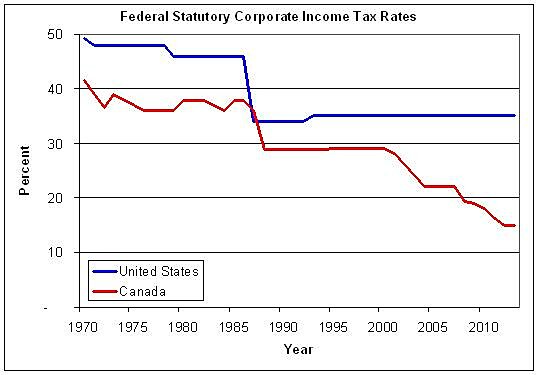

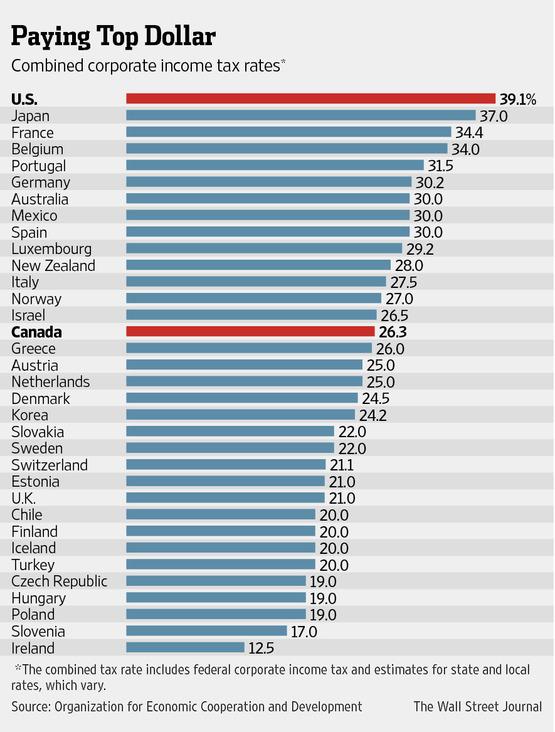

WSJ Graphics on Twitter: "U.S. has a combined corporate income tax rate of 39.1% vs. Canada with 26.3% http://t.co/w4ipbePP8I http://t.co/0UfL444NjJ" / Twitter

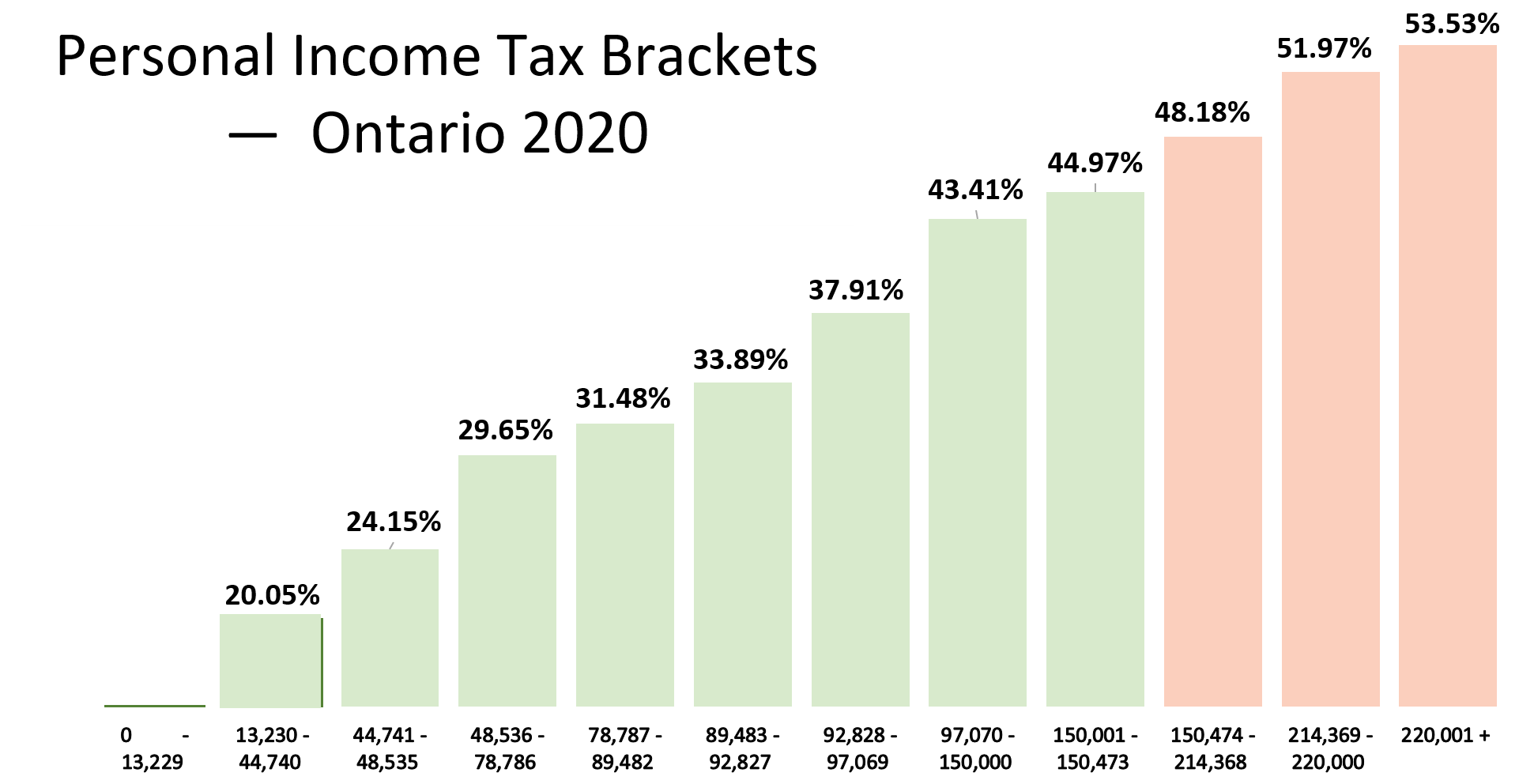

top-combined-personal-income-tax-rate-in-canadian-provinces-in-2016-infographic.jpg | Fraser Institute

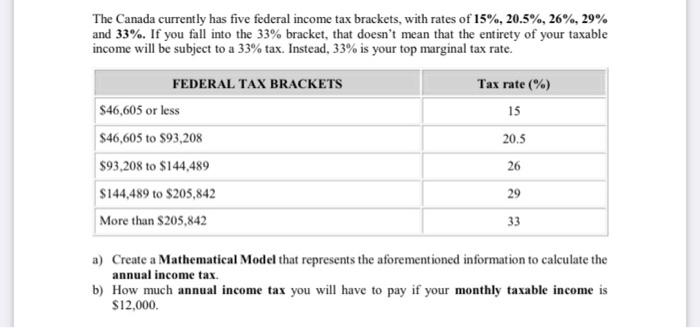

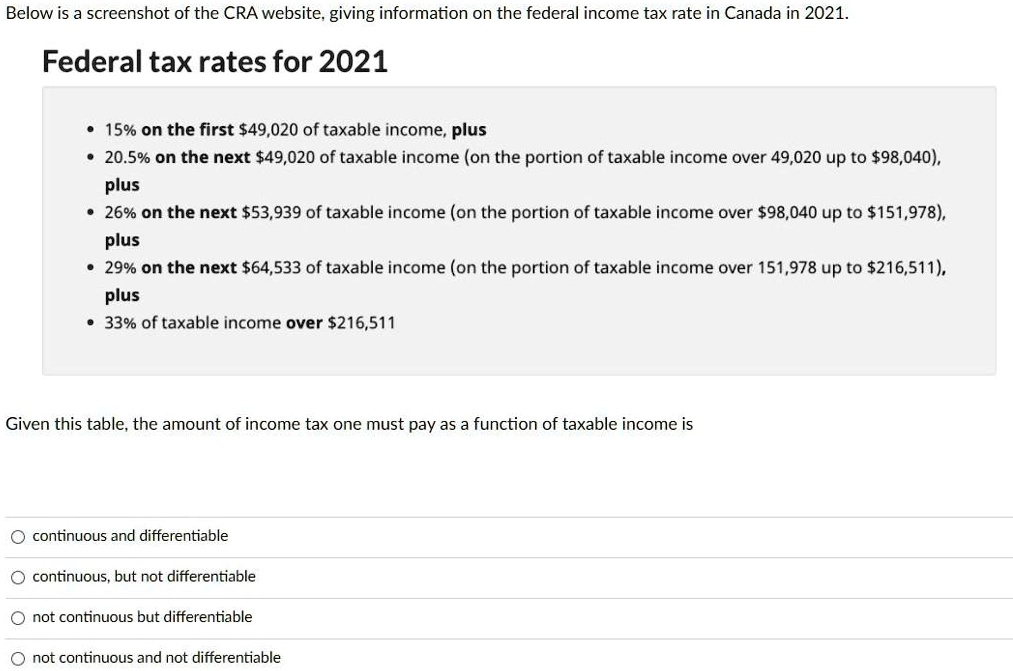

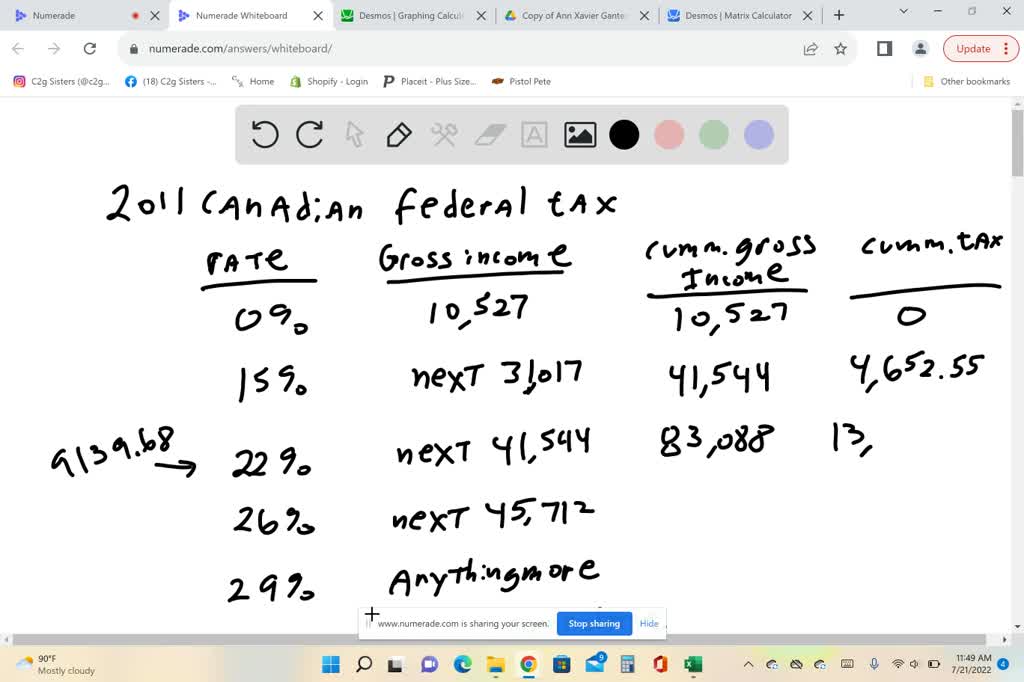

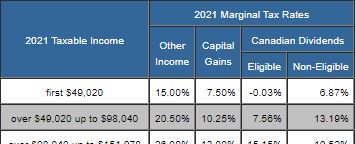

SOLVED: Below is a screenshot of the CRA website: giving information on the federal income tax rate in Canada in 2021 Federal tax rates for 2021 15% on the first 549,020 of

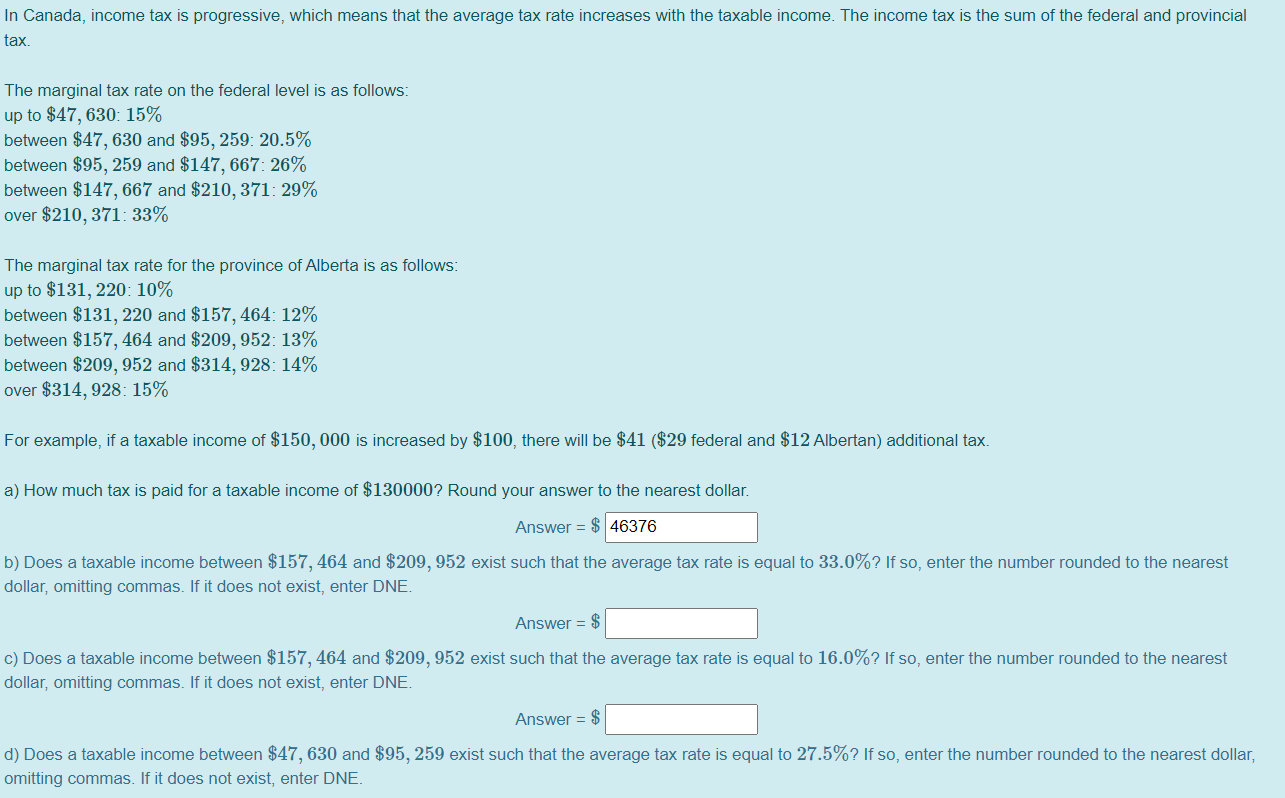

2022 tax rates, brackets, credits | combined federal/provincial tax brackets | Manulife Investment Management

![The Basics Of Tax In Canada - [Updated For 2022] The Basics Of Tax In Canada - [Updated For 2022]](https://workingholidayincanada.com/wp-content/uploads/2022/04/Canada-Federal-Tax-Rates-2022.png)